Central Garden & Pet (NASDAQ:CENT) has had a tough week with its share value down 4.7%. However, the corporate’s fundamentals look fairly first rate, and long-term financials are often aligned with future market value actions. In this text, we determined to concentrate on Central Garden & Pet’s ROE.

Return on Equity or ROE is a take a look at of how successfully an organization is rising its worth and managing buyers’ money. In less complicated phrases, it measures the profitability of an organization in relation to shareholder’s fairness.

See our latest analysis for Central Garden & Pet

How Do You Calculate Return On Equity?

ROE might be calculated through the use of the formulation:

Return on Equity = Net Profit (from persevering with operations) ÷ Shareholders’ Equity

So, primarily based on the above formulation, the ROE for Central Garden & Pet is:

8.4% = US$121m ÷ US$1.4b (Based on the trailing twelve months to June 2023).

The ‘return’ is the quantity earned after tax over the past twelve months. So, which means for each $1 of its shareholder’s investments, the corporate generates a revenue of $0.08.

What Is The Relationship Between ROE And Earnings Growth?

So far, we have discovered that ROE is a measure of an organization’s profitability. We now want to guage how a lot revenue the corporate reinvests or “retains” for future progress which then provides us an thought in regards to the progress potential of the corporate. Generally talking, different issues being equal, corporations with a excessive return on fairness and revenue retention, have the next progress price than corporations that don’t share these attributes.

Central Garden & Pet’s Earnings Growth And 8.4% ROE

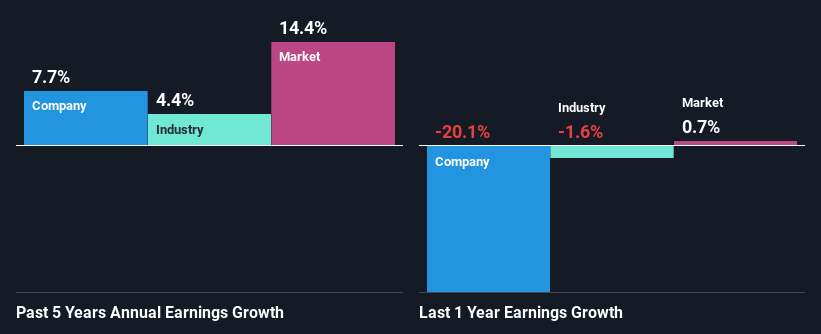

When you first take a look at it, Central Garden & Pet’s ROE would not look that engaging. A fast additional examine exhibits that the corporate’s ROE would not examine favorably to the business common of 15% both. Although, we are able to see that Central Garden & Pet noticed a modest internet revenue progress of seven.7% over the previous 5 years. So, there could be different elements which are positively influencing the corporate’s earnings progress. For instance, it’s doable that the corporate’s administration has made some good strategic choices, or that the corporate has a low payout ratio.

Next, on evaluating with the business internet revenue progress, we discovered that Central Garden & Pet’s progress is sort of excessive when in comparison with the business common progress of 4.4% in the identical interval, which is nice to see.

The foundation for attaching worth to an organization is, to an amazing extent, tied to its earnings progress. What buyers want to find out subsequent is that if the anticipated earnings progress, or the shortage of it, is already constructed into the share value. Doing so will assist them set up if the inventory’s future seems promising or ominous. One good indicator of anticipated earnings progress is the P/E ratio which determines the worth the market is prepared to pay for a inventory primarily based on its earnings prospects. So, chances are you’ll need to check if Central Garden & Pet is trading on a high P/E or a low P/E, relative to its business.

Is Central Garden & Pet Using Its Retained Earnings Effectively?

Given that Central Garden & Pet would not pay any dividend to its shareholders, we infer that the corporate has been reinvesting all of its income to develop its business.

Summary

On the entire, we do really feel that Central Garden & Pet has some optimistic attributes. With a excessive price of reinvestment, albeit at a low ROE, the corporate has managed to see a substantial progress in its earnings. That being so, the latest analyst forecasts present that the corporate will proceed to see an growth in its earnings. To know extra in regards to the firm’s future earnings progress forecasts check out this free report on analyst forecasts for the company to find out more.

Have suggestions on this text? Concerned in regards to the content material? Get in touch with us straight. Alternatively, e-mail editorial-team (at) simplywallst.com.

This article by Simply Wall St is common in nature. We present commentary primarily based on historic information and analyst forecasts solely utilizing an unbiased methodology and our articles are usually not meant to be monetary recommendation. It doesn’t represent a suggestion to purchase or promote any inventory, and doesn’t take account of your targets, or your monetary scenario. We goal to deliver you long-term centered evaluation pushed by elementary information. Note that our evaluation might not issue within the latest price-sensitive firm bulletins or qualitative materials. Simply Wall St has no position in any shares talked about.